Target accounts calculated from source accounts¶

In the example social security expenses of the wages is defined.

A-to-a tabs: List, Source, Target, Numbers and Now

List tab¶

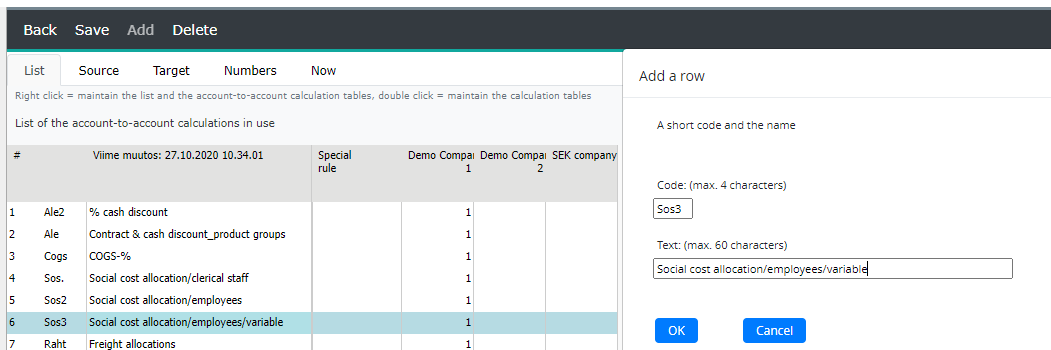

1. Add new calculation row, by right clicking the row text. Choose Add above/below.

2. Enter the code and name, (Sos3, social cost calculation). Right click calculation row text, and choose Maintain this calculation. Choose the company. The Source tab is opened. If needed, the calculation’s company selection can be modified in the List tab. Right click row text and select: Add/Remove company. Mark 1, in the company column indicates the selection.

Special rule column has no value as default. If needed, define rule for the source accounts. E.g. the calculation is done on the basis of a monthly average, or cumulative values. Right click the column and select calculation rule for the row.

Note

Calculations on the List tab are performed from top to bottom. This enables to chain calculations. I.e. it is possible to use target accounts, which are calculated already, as a source for the lower calculations. For example, calculation can be used to make a general salary increase.

The wage increase will also raise social security contributions, so the source of social security expenses, is also the wage increase target account. I.e. the salary increase must be calculated before social security contributions, in order to make the calculation go correctly.

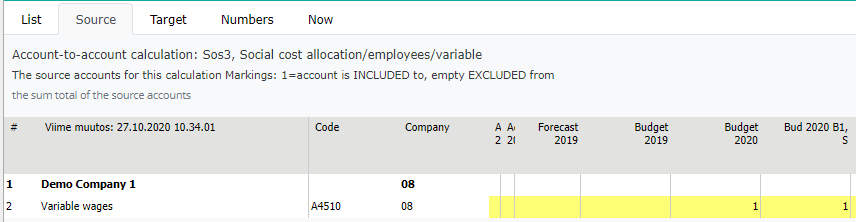

Source tab¶

In the Source / Target tab, the time periods in which the calculation is in force are marked with 1. The selection can be made for all period’s years (and versions) by entering 1, to the ” Forecast all ” -column, for example. By opening the period group, from the column header’s right-click menu, the validity can be specified for a specific year, or further for months, by opening the year. In the Numbers tab the year-specific multipliers are defined. Open the group, for example Forecast all, from the right-click menu, and define multipliers. If needed, the year column can be opened for months, to define monthly multipliers.

3. Move on to the Source tab. Press Add button, and select the wage accounts, from which the social expenses are calculated from.

Mark 1 to the period’s year column, in which the calculation is in force.Entries can be copied from another period by right-clicking target year’s column header, and selecting Copy corresponding values to this year. Select a time period.

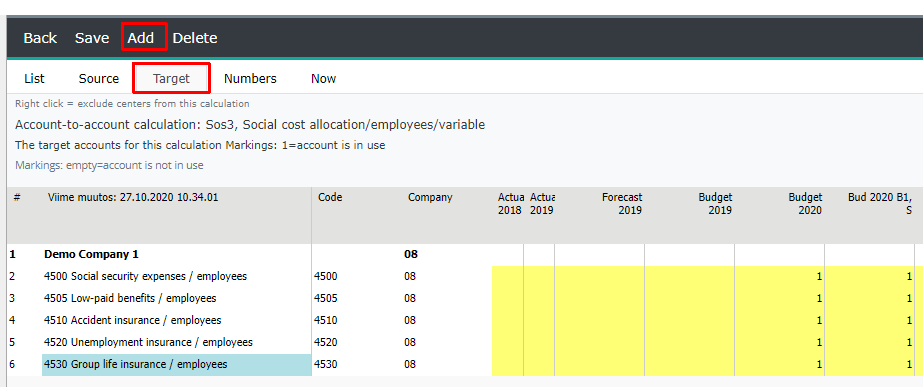

Target tab¶

4. Move on to the Target tab. Press Add button, and select the social security expenses accounts, and choose desired years, by ticking 1, in the respective column. Entries can be copied from another period by right-clicking target year’s column header, and selecting Copy corresponding values to this year. Select a time period.

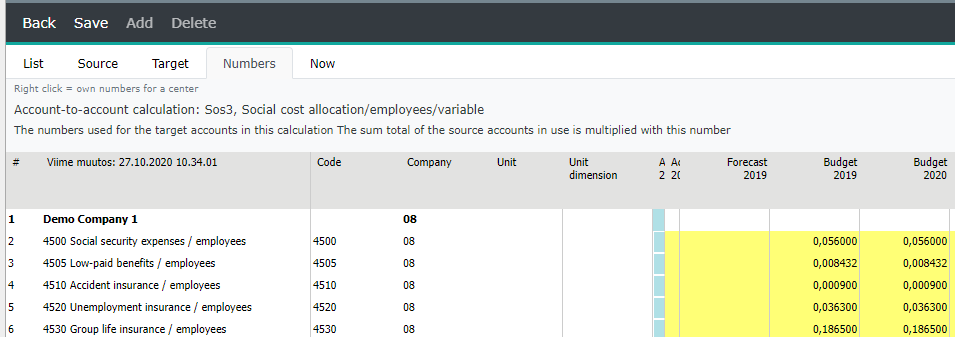

Numbers tab¶

5. Move on to the Number -tab. Open the period group and enter the social security cost percentages. Numbers can be entered for the whole year -numbers are in force for every month, or separately for each month, by opening the year column. Existing multipliers can be copied from another period by right-clicking target year’s column header, and selecting Copy corresponding values to this year. Select a time period.

Own numbers for the cost center /dimension¶

To determine different numbers for a cost center (or dimension), use right mouse menu option: Own numbers for a center. For instance, choose centers and enter numbers for them.

Note

Please note that, for example, if a cost center has Own Numbers defined, but in entry the data is entered at the cost center group level, own numbers will not load until after the tree level is reloaded (and saved). However, if the entry is made at the cost center level, own numbers are updated immediately.

Now tab¶

6. Move on to Now tab, in order to see the report, with currently defined calculations.

Account-to-account calculation result¶

(Source accounts total) * (target accounts monthly percentage per month) = (the balance of the target account per month

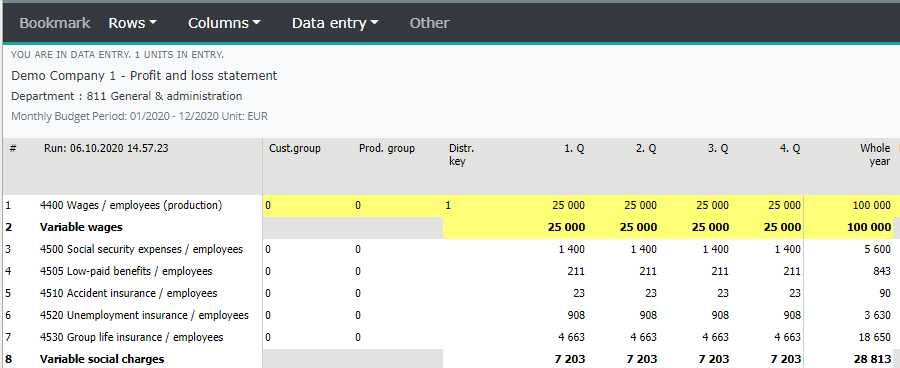

In the entry, the social security expenses accounts are displayed for the time period specified. Below is an excerpt from the budget entry, with wage and social security expenses accounts. The value for the social security expenses are calculated automatically based on the specified percentages.

Note

If the social security expenses accounts are open in entry, please check, in the a-to-a maintenance, that the periods has been correcty defined.