Group Consolidation (GC)¶

Group Consolidation is cube in Tabella and combines:

Entities (cubes) from Tabella

Manual entries (monthly or cumulative voucher input)

Eliminations

Group bookings (for example acquisition cost calculations)

Data from calculations

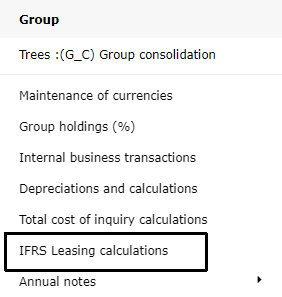

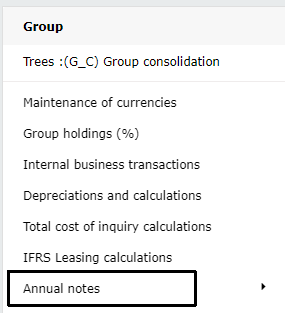

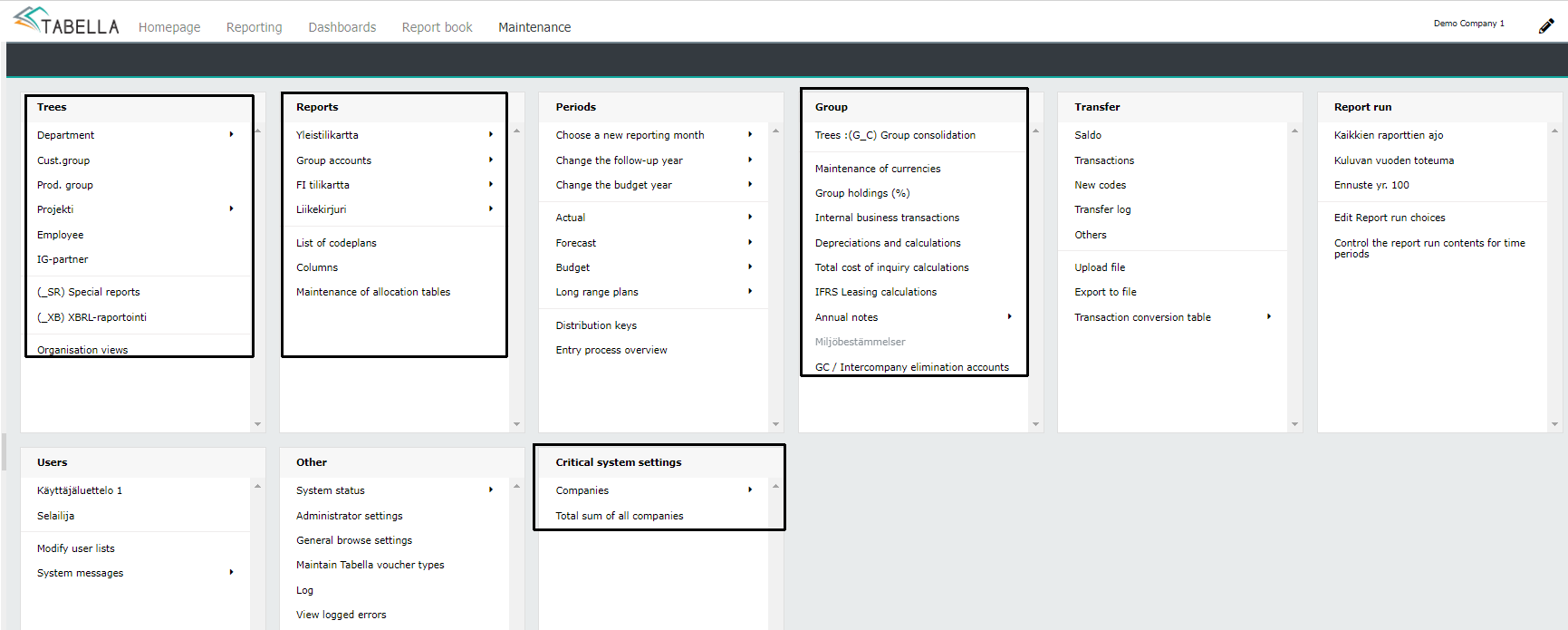

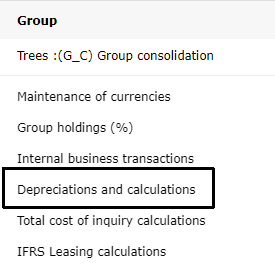

Settings for maintaining Group are located in Tabella Maintenance > Group

Setting up Group Cube¶

Group entities (cubes) and settings are located in Tabella Maintenance > Critical System Settings > Companies.

First step in setting up Group is to create Group Cube (GC) in Tabella:

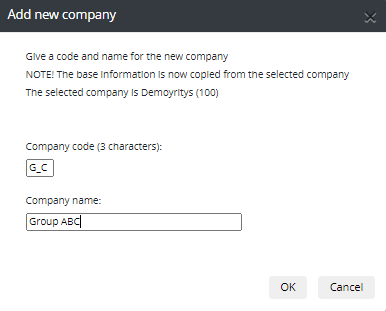

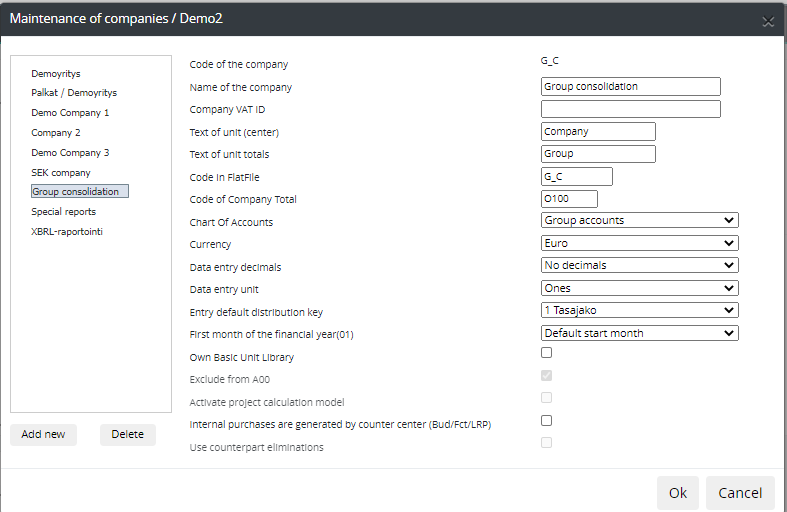

Maintenance > Critical System Settings > Companies > List of companies > Click Add New > Input group code G_C > Input group name > Save by clicking OK.

Set all settings for Group from drop down menus for example choose chart of accounts to be used. If elimination method to be used is counter company elimination, mark Use counterpart elimination. If automation for creating purchase transactions from sales transactions is used, mark Internal purchases are generated by counter center.

After creating Croup Cube, Group structures can be created and Tabella’s entity mappings to Group structure can be made.

Group structure¶

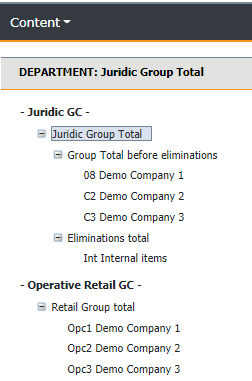

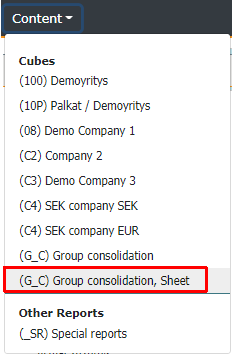

Group Consolidation cube is found from Tabella’s Content-menu.

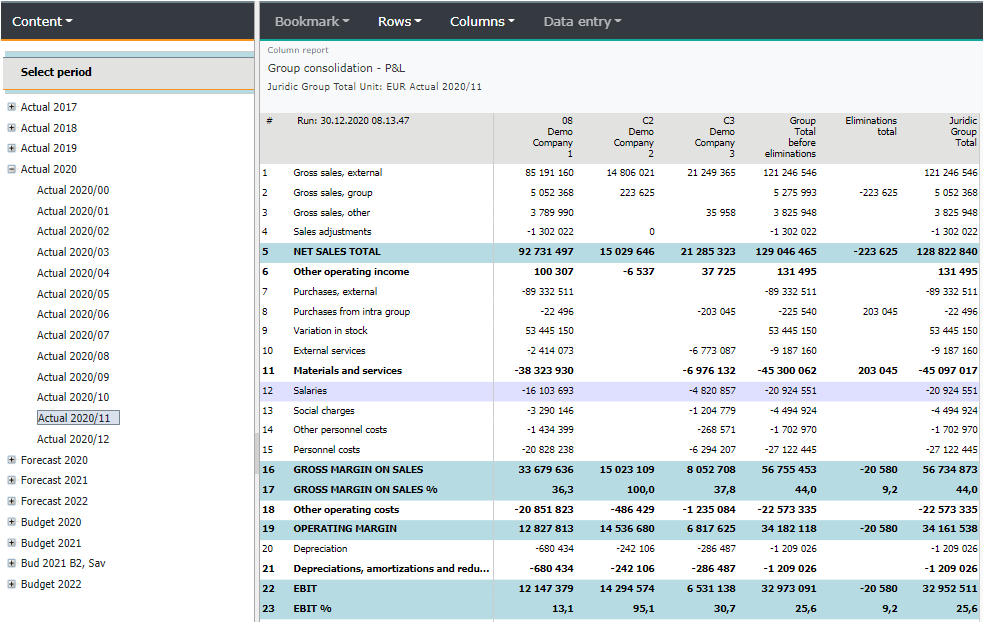

In Tabella there can be several alternative consolidation hierarchies in use for example Juridic and Operative.

Group structure’s tree hierarcy typically includes following main levels:

Total Group eliminated

Total Group before eliminations

Group companies before eliminations

Group eliminations

Maintenance of group tree hierarcy:

Enities consisting Group are combined in Tabella into one model in Group Consolidation.

Group tree structure and entity mappings are located in Tabella Maintenance > Trees > Department > G_C Group Consolidation.

Note

Note naming restricition: Elim is parameter in Tabella’s programming code and can not be used. ELIM can be used instead.

If alternative Group tree structures are used, separate elimination units have to be created for all tree structures.

More information about maintenance of tree structures.

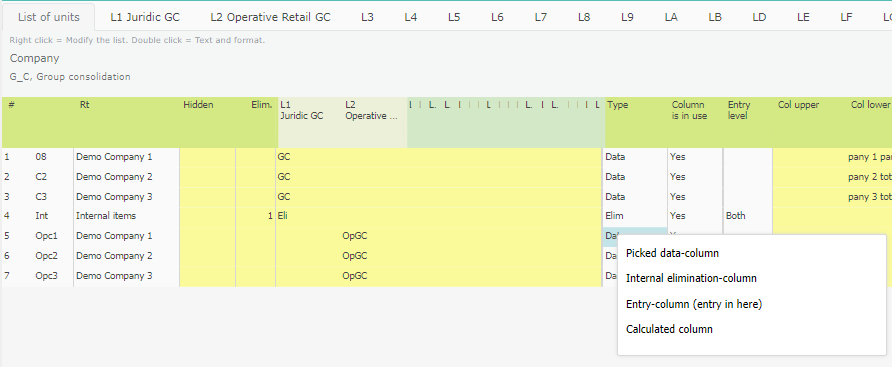

List of units-tab contain tree hierarchies lowest level units and other tabs (L1, L2…) contain tree hierarchies roll up structures and their upper level units.

List of units-tab columns:

Elim-column:

If level-elimination method is used in group that contains sub-group, elimination levels are marked with 1 and 2 in Elim-column.

Corresponding markings are made in chart of accounts for accounts that are eliminated in level 1 and/or level 2.

Type-columns defines unit types:

Data: Data is linked from source company (Data-column: Picked-data column)

Calc: Data is created by calculation rule

Entry: Data is entered manually

Elim: Data in created by Tabella’s elimination method or manually input by voucher entry

Entry-level column:

Elimination method is selected for Elim-type unit:

Countercompany elimination method can be applied for profit or balance accounts or both (Profit, blance, Both).

If level elimination method is applied, LevelE must be chosen.

For Entry-type unit:

Selection is based if entered values are monthly or accumulated values.

For Data-type unit:

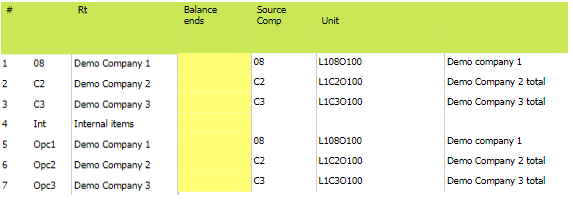

Source companies and source units are selected in Source Comp- and Unit-columns

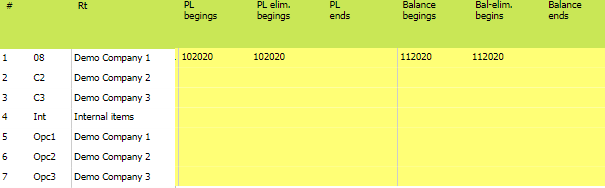

PL begins, Balance begins, PL elim begins, PL ends, Balance ends, Bal-elim begins-columns:

Data linking starting and ending months from source company can be restricted, for example company’s profit is consolidated to group from october and balance from november 2020. Also starting and ending months for eliminations can be restricted accordingly.

Alla olevalla esimerkillä kuvataan, miten data käyttäytyy, kun datan noudon aikaa on rajoitettu yksiköllä. Nollaus toimii seuraavasti, kun raporttien ajossa on käynnissä vuoden 2019 ajo.

Tuloslaskelma:

jos alkaa 2018 , pidetään kaikki data eli ei nollata mitään

jos alkaa 2019 , nollataan alkuvuoden tulosdata, aloituskuukausi pidetään

jos alkaa 2020 , nollataan kaikki data

jos päättyy 2020 , pidetään kaikki data eli ei nollata mitään

jos päättyy 2019 , nollataan loppuvuoden tulosdata, pidetään loppukuukausi

jos päättyy 2018 , nollataan kaikki data

Tase:

jos alkaa 2018 , pidetään kaikki data eli ei nollata mitään

jos alkaa 2019 , siirretään alkuvuoden data aloituskuukaudelle lisäykseksi

jos alkaa 2020 , nollataan kaikki tasedata

jos päättyy 2020 , pidetään kaikki data eli ei nollata mitään

jos päättyy 2019 , nollataan loppuvuoden tasedata, pidetään loppukuukausi

jos päättyy 2018 , nollataan kaikki tasedata

Group Chart of Accounts¶

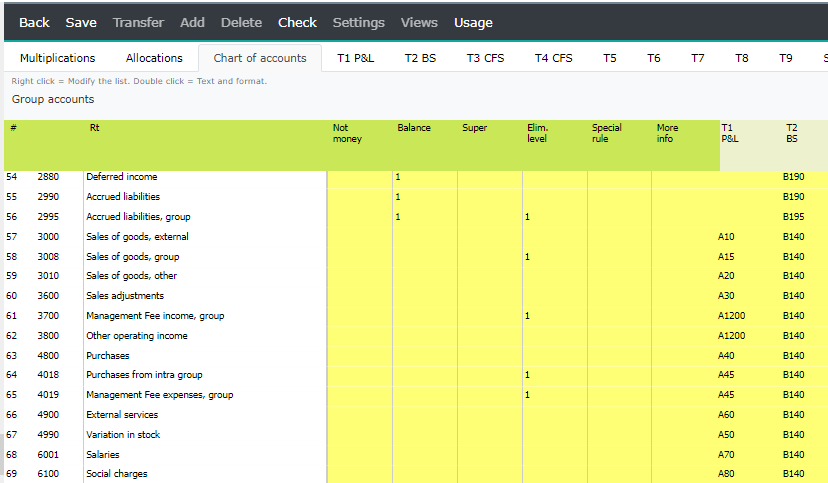

Charts of accounts are located in Tabella Maintenance Reports-section.

Subsidiaries can use their own chart of accounts that differ from Group’s parent company’s chart of accounts.

Subsidiary’s chart of accounts can be mapped to Group’s chart of accounts by entering corresponding group account codes to Group account-column in subsidiary’s chart of account.

If Level elimination method is used, accounts requiring elimination are marked with 1 in Elim level-colum in Group’s chart of accounts. If sub-group exists and if there is more elimination unit than one in group tree structure, also 2, 3, 4, can be marked in Elim level-colum.

More information about accounts settings

Group Consolidation Sheet¶

Group Consolidation Sheet can be found from Content-menu when logged in to GC. In Group Consolidation Sheet Group companies and elimination units are positioned in columns.

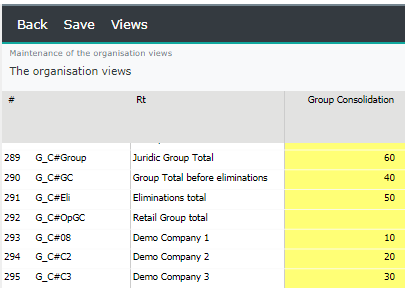

Group Consolidation Sheet is based on Organisation View in Tabella.

There can be several Group Consolidation Sheets in use. Sheet is selected from Columns-menu in Reporting.

To create Organisation View for Group Consolidation Sheet go to Maintenence > Trees > Organisation Views.

More information about Organisation Views

Group bookings with voucher entries¶

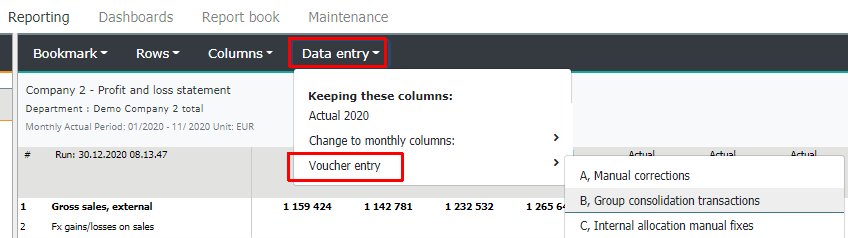

Voucher entry:

Bookings can be made manually with vouchers from Reporting > Data entry-menu > Voucher entry.

More information about Vouchers

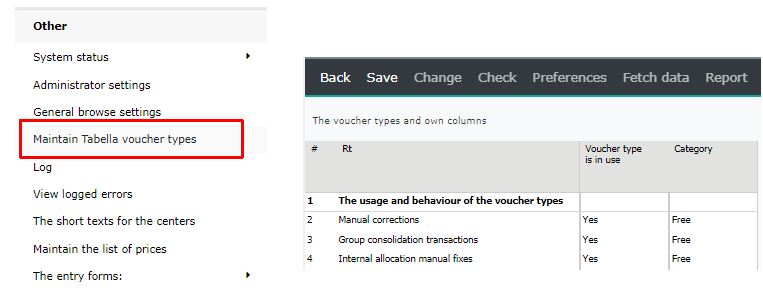

There can be more than one voucher type to categorise different types of group bookings. More voucher types can be created in Maintenance > Other > Maintain Tabella voucher types.

Level elimination settings¶

Maintenance > Other > Administration settings > Level elimination type (if in use). First setting clones transactions from accounts marked as elimination accounts in chart of accounts Second setting converts elimination accounts to E_accounts.

More information about Adminstrator settings

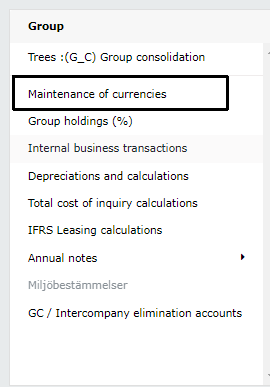

Maintenence of currencies¶

Select Maintenance > Maintenance of currencies

Maintenance

Define currencies, texts and rates for time periods and versions.

Settings: Usage of monthly average rate, defining exchange rate difference account and retrieval of rates automatically from Bank of Finland.

Tabs

Maintenence of currencies has two tabs:

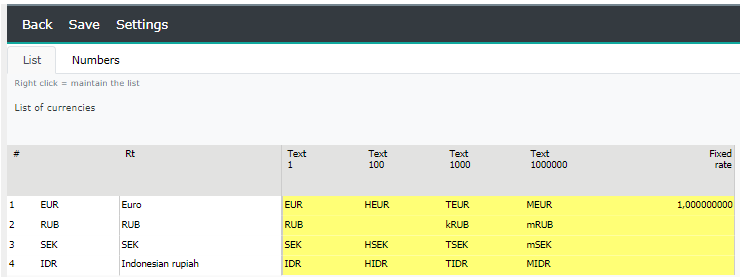

1. List:

All currencies in use.

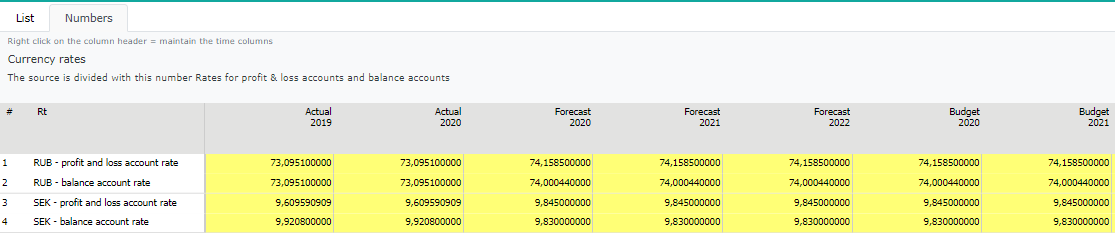

2. Numbers:

Rates can be defined monthly or yearly and by version (actual, budget, forecast, lrp).

List-tab¶

If currency row has been created to table, text and rate of row can be modified.

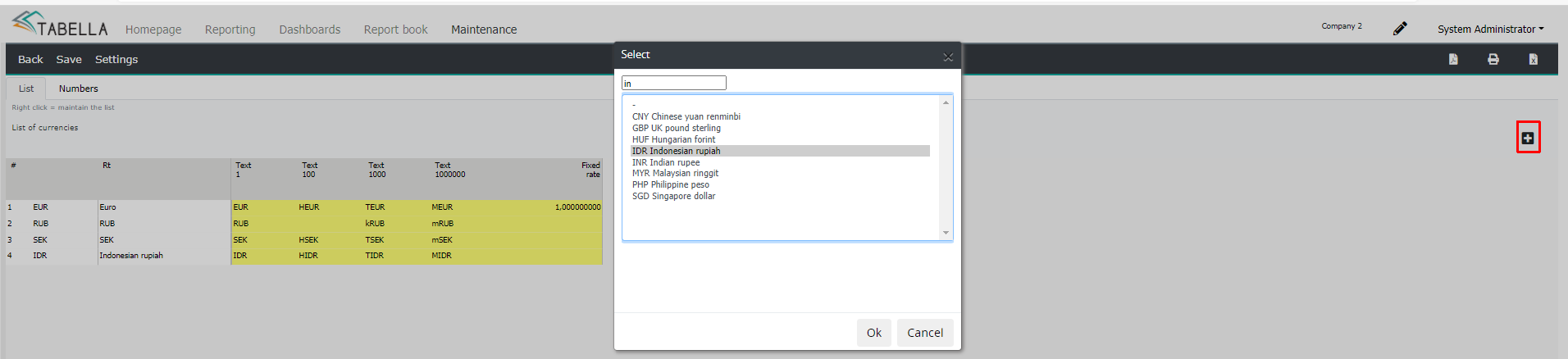

Create new currency

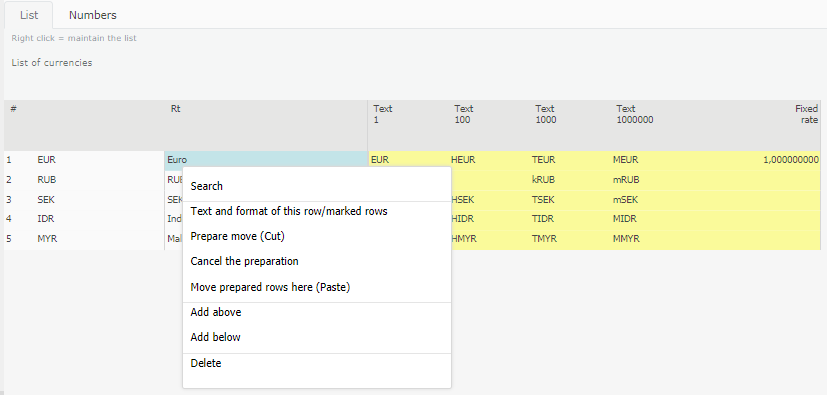

Automatically: Right-click and select Add above/below.

Note

Remember to manually update rates for budget, forecast or lrp.

Manually: On list-tab on row text right-click and select add new currency.

By opening selection with right-click, texts can be edited and currency removed.

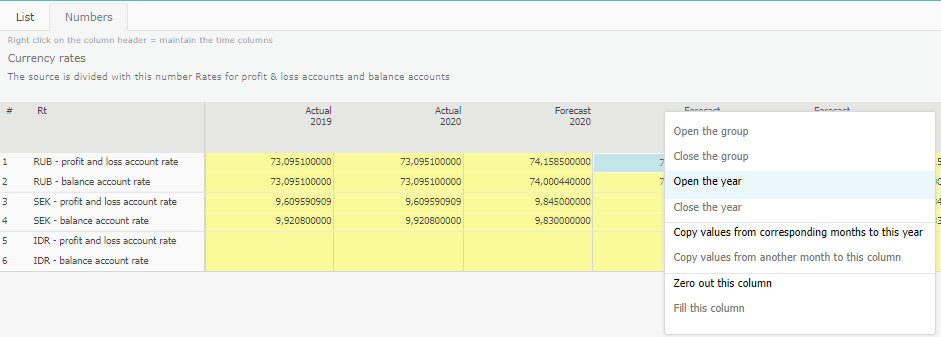

Numbers-tab¶

Numbers-tab shows all time periods and versions.

Manually input rates for all time periods and versions. For each category there are two rates, income statement and balance sheet rates.

Monthly rates can be input by opening monthly level with right mouse click to column-header Open the year.

Copy values from corresponding months to year. Select time period.

Monthly or yearly

Rates can be inputted to monthly or yearly levels.

Row values can be copied or zeroed out with right-click.

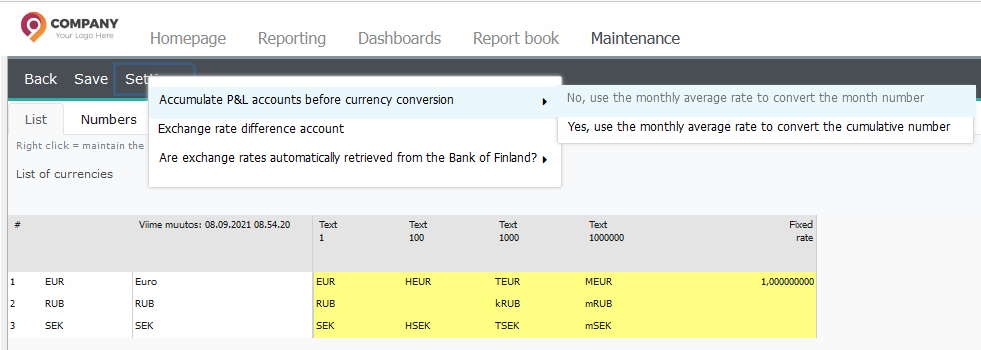

Currency Settings¶

Settings

Use of monthly average rates for PL accounts and exhange rate difference account is defined here. Tabella Cloud enables automatic exchange rate retrieval from the Bank of Finland.

Use monthly average rates for PL accounts

-No, use the average rate for the month

-Yes, use the rate calculated from the average exchange rates for the months

See also: Cumulative exchange difference, table examples.

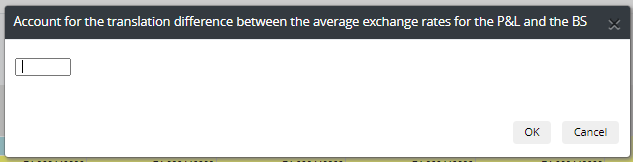

Exchange rate difference account

Define exchange rate difference account for PL and BS average rates difference booking. Account is steered into balance sheet to correct Shareholders Equity after currency translation.

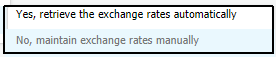

Automatic retrieval of exchange rates from Bank of Finland

Select Yes, retrieve rates automatically to automate maintenance of rates.

All actual rates for currencies defined in Tabella, are retrieved automatically nightly. Monthly and yearly average rates are calculated (including cumulative average rates). At the beginning of new year, previous year’s ending rates will be retrieved. After this, only current year’s rates will be retrieved.

Note

Remember to manually update rates for budget, forecast or lrp.

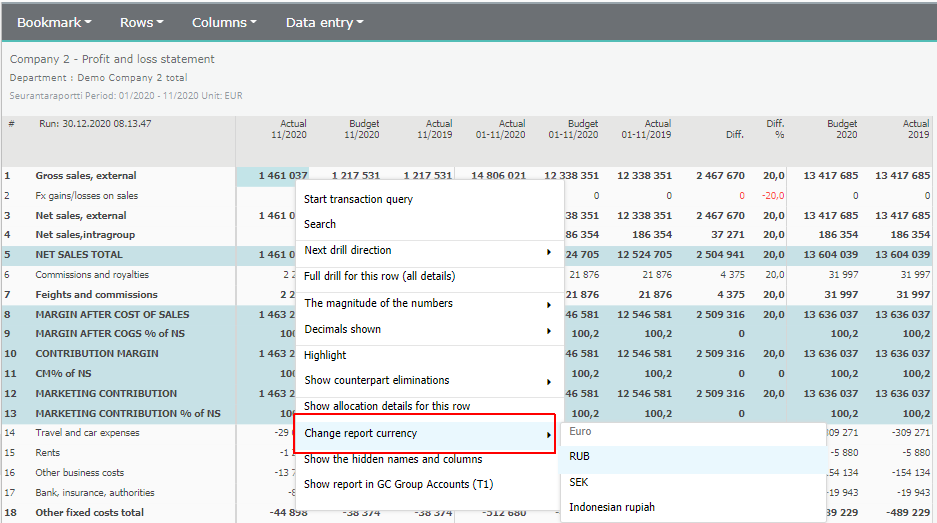

Selecting currency in reporting - Currency can be selected with right-click from Change Report Currency-menu.

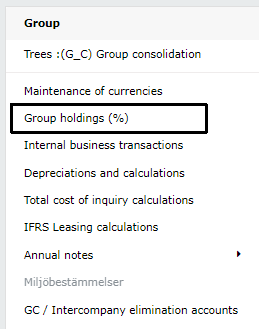

Managing Ownership (%)¶

All GC entities that have Type “Data” or “Entry” are displayed automatically in Group holdings (%)-table. All time periods are displayed at columns.

If parent entity’s ownership is under 100 %, ownership can be defined as yearly or monthly percentages.

Entered ownership percentage is calculated in data retrieval from source company to GC and in counter company eliminations.

Note

Remeber to maintain percentages manually after new time periods are opened in Tabella.

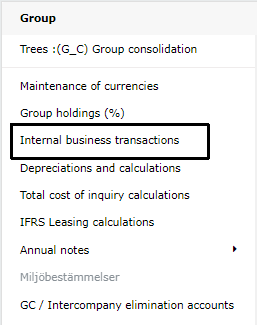

Internal Business Transactions¶

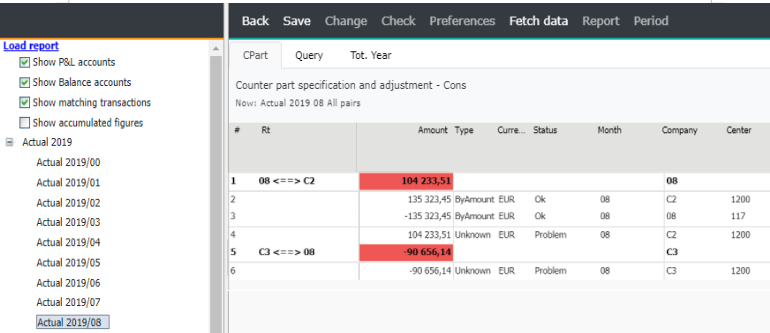

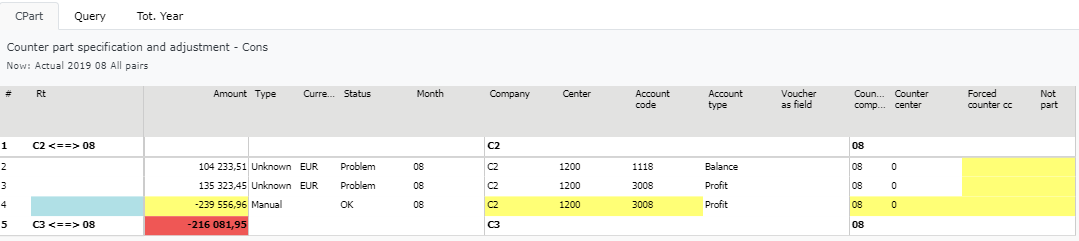

An intercompany transaction is a transaction between two entities in an organization. Tabella enables you to track and reconcile intercompany transaction details across accounts monthly or cumulatively based on transaction’s counter company code.

Data is updated into table by report run. Fetch data-button can be used to update data manually. Chose period and version from left hand side pane, for example Actual 2019.

Select month for example 08/2019. By selecting Slow Matching Transactions-check box, all transactions are shown where counter company and amount matches.

If transaction has matching company /cost center/ account/ counter company, Type-column displays “ByAmount” and Status-column displays “Ok”. For example company C2 has matching amounts as debet- and credit-bookings.

If transaction has no matching amount form counter company, Type is Mix / Unkonown and Status is Problem.

Sum of non-matched transactions is displayed in red. Correction row can added to the table or alternatively corrections can be made directly to book keeping source system or as voucher bookings in Tabella.

Type Mix: No matching amount for PL account (or Balance account) is found from counter company’s PL accounts (or Balance accounts), but there exists amount about same size on Balance account.

Unknown: Matching amount is not found

Other Type & Status codes below.

Manual correction row can be added to the table with right-click Add row.

Manual correcations can be entered to yellow cells. Correction row’s typeis always Manual.

Difference Amount is automatically displayed, but can be manually altered. Several correction rows can be added to the same Company - Counter Company combination.

By marking 1 to No Part-column, marked row is ignored from eliminations.

Transactions can be drilled by double clicking column.

Changes are updated to reporting after running reports

Note

Corrections affect only Group elimination unit in GC, not source company data.

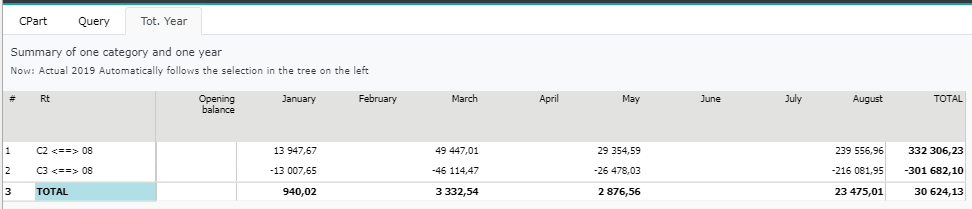

Tot. Year-tab shows matching over months (cumulative until selected month).

Short description of Status and Type- columns

Status:

ok - all is ok

problem - something is not ok, check

ignore - no need to check

corr_other - row corrected manually (corr center or not part)

corr_manual - manually added correction row

Type:

Unknown - counter part not found (reason unknown) → reconcile manually / add Manual-correction row or mark row as NotPart

TotDiff - counter parts found, but amounts differ

Null - can be ignored, for example same cost center, account, counterpart, +/- correction. No need to manually mark, automatically ignored from counterpart matching

ByAmount - counter part found and amount matches.

DifSum - matched within tolerance

SplitSrc - Amount matched by splitting source-row

SplitTgt - Amount matched by splitting target-row

SplitOUT - original splitted row (for example 1 sales row, 5 purchase rows -> sales row is splitted to purchase rows

GiveUp - matching of sum failed

Mix - balance vs profit vs balance - other part’s internal sale is booked into counter part’s balance instead of purchase

Manual - Manually added correction row

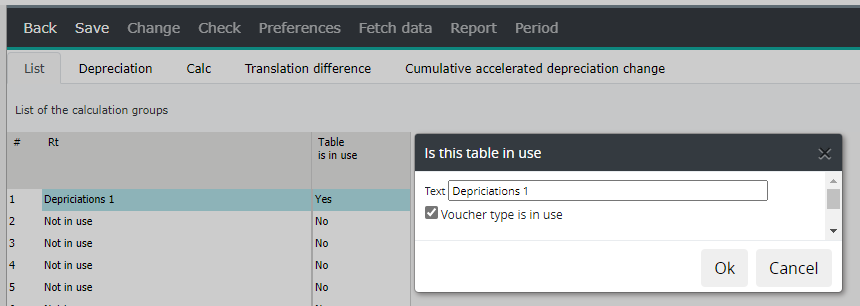

Poistot ja laskennat¶

Luettelo -välilehti. Ota laskentataulukko kayttöön. Klikkaa rivitekstiä oikealla hiirellä. Määrittele nimi ja pane merkintä kohtaan Tämä laji on käytössä

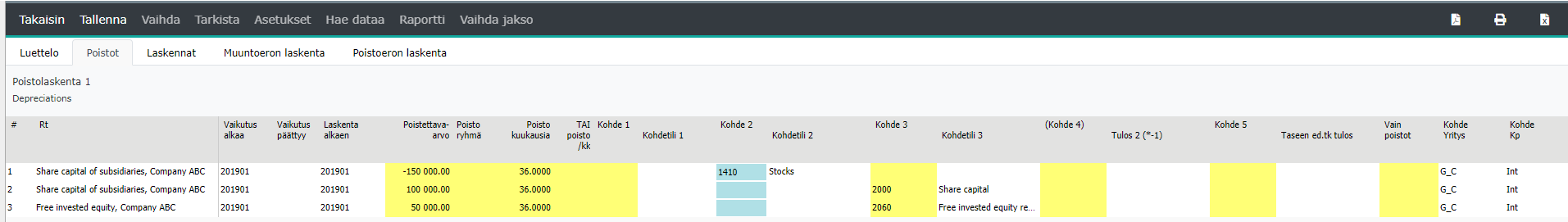

Poistot

Välilehdellä voidaan automatisoida mm. hankintamenolaskelmaan liittyvän liikearvon poistolaskentasäännöt.

-Liikearvoa (goodwill) syntyy usein yrityskaupan yhteydessä kauppahinnan ja ostetun yrityksen nettovarallisuuden erotuksesta.

-Suomen kirjanpitolain mukaan liikearvon hankintameno voidaan aktivoida taseeseen. Jos liikearvo on aktivoitu, sen hankintameno on poistettava suunnitelman mukaisin poistoin.

Sarakkeet

Vaikutus alkaa: -mistä kuukaudesta alkaen laskennan lopputulos halutaan raportille

Vaikutus päättyy: -mistä kuukaudesta päättyen laskennan lopputulos halutaan pois raportilta

Laskenta alkaen: -mistä kuukaudesta laskenta alkaa

Poistettava arvo: -arvo, josta poistot lasketaan

Poisto ryhmä: Samaan ryhmään kuuluvaksi merkityt laskentarivit yhdistetään laskettaessa lopputulosta kohteelle

Poisto kuukausia: -kuukausien lukumäärä

TAI poisto/kk: -vaihtoehtoisesti kk-poiston määrä

Kohde 1: -valitse hiiren oikealla listalta tulostili jolle laskennan lopputulos kirjataan

Kohdetili 1: -näyttää valitun tilin nimen

Kohde 2: -valitse hiiren oikealla listalta tase-tili (vastaavaa) jolle laskennan lopputulos kirjataan

Kohdetili 2: -näyttää valitun tilin nimen

Kohde 3: -valitse hiiren oikealla listalta tase-tili (vastattavaa) jolle laskennan lopputulos kirjataan

Kohdetili 3: -näyttää valitun tilin nimen

(Kohde 4): -tulos 2 (*-1)

Kohde 5: -taseen ed. tk tulos

Vain poistot: -merkintää käytetään seuraavan kauden alkusaldojen generoinnissa.

Kyllä -merkinnällä Kohde 5 -tilille kirjataan avaava saldo ilman edellisen kauden avaavaa - eli vain poistoista generoidaan alkusaldo (vaikuttaa vain Kohde 5 -tiliin)

Kohde yritys: -valitse hiiren oikealla listalta yritys jolle kirjaus tehdään

Kohde kp: -valitse hiiren oikealla listalta kustannuspaikka jolle kirjaus tehdään

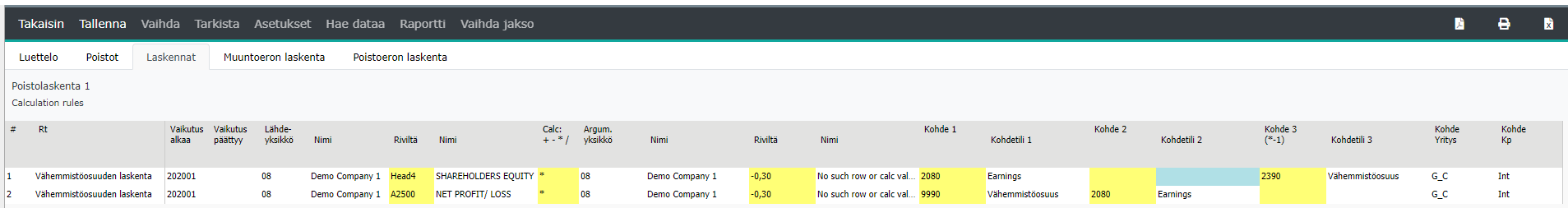

Laskennat

Välilehdellä voidaan automatisoida mm. konsernin vähemmistösuuksien laskennat ja vaihto-omaisuuteen sisältyvien sisäisten katteiden eliminoinnit (sisäiset varastokatteet)

Kuvissa esimerkki vähemmistöosuuden laskennasta, jossa lasketaan 30 % omasta pääomasta ja tilikauden tuloksesta sekä tehdään kirjaukset G_C:n eliminointiyksikköön (Int).

Muuntoeron laskenta

Välilehdellä voidaan automatisoida mm. hankintamenolaskelmiin liittyvät ulkomaisten tytäryritysten oman pääoman muuntamisessa syntyvien kurssierojen sekä sisäisen voitonjaon eliminoinnin kurssierojen käsittelyt.

Sarakkeet

Vaikutus alkaa: -mistä kuukaudesta alkaen laskennan lopputulos halutaan raportille

Vaikutus päättyy: -mistä kuukaudesta päättyen laskennan lopputulos halutaan pois raportilta

Laskenta alkaen: -mistä kuukaudesta laskenta alkaa

Valuutta: -hankinnan valuutta

Valuutta määrä: -hankinnan valuuttamääräinen arvo

Eur määrä: -hankinnan arvo euroissa

Valuuttakurssi: -kun em. tiedot on annettu, ohjelma laskee kurssin automaattisesti

Kohde 1: -valitse hiiren oikealla listalta tili jolle laskennan lopputulos kirjataan

Kohde 2: -valitse hiiren oikealla listalta tili jolle laskennan lopputulos kirjataan

Kohde yritys: -valitse hiiren oikealla listalta yritys jolle kirjaus tehdään

Kohde kp: -valitse hiiren oikealla listalta kustannuspaikka jolle kirjaus tehdään

GC / Intercompany elimination accounts¶

Booking of elimination differences can be automated by creating booking rule in Tabella.

Right-click in table and add new row by selecting add below. Enter code and name for new row.

Enter company code and G_C for Unit-column

Unit - Specify elimination unit or if left empty, differences in all elimination units will be booked accordingly.

Enter Source account 1, for example sales account. Also Row-model code can be used.

Enter Source account 2, for example purchase account. Also Row-model code can be used.

Enter Target account where difference is booked.

Difference between source 1 & 2 accounts will be booked automatically to difference account for all elimination units if Unit-column has been left empty.