Transactions¶

Normally the saldo’s and transactions are transferred to Tabella separately, because the transactions total does not always match the account saldos. If only transactions are transferred, then account saldo’s are calculated from them.

Transactions (and saldos) are fetched from the Tabella’s Transfer directory, into which they have been, in general, transferred automatically.

If needed, transaction files can be transferred to the Transfer directory manually. Choose option Upload file. Choose files and press OK. Selected files are transferred to the Transfer directory, from where they are read in to Tabella, by using transaction transfer.

Supported files are: .txt | .csv | .dat | .tra | .xml | .xls | .xlsx | .se | .las | .til | .tun

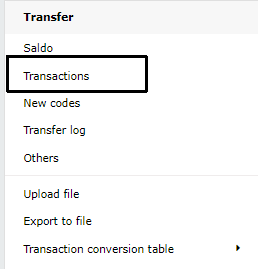

Choose Transactions | Standard transfer

All files found in Tabella’s Transfer directory are shown.

Transfer accounting systems transactions to Tabella.

Choose file. Press OK.

Transactions are transferred to Tabella.

Note

Transferring transaction data is company-specific.

Report run updates data.

Check and maintain possible new codes; cost centers / accounts.

If transaction has no cost center, the cost center is set to value 0

In the chart of account maintenance, balance accounts are marked with sign “1”, which separates them from P/L accounts. The necessity of this marking is company-specific, and is defined during Tabella system installation.

Balance accounts’ marking separates them from Profit and loss accounts, and this affects on how the signs (+/-) are handled in transfer. For example, if a new balance account is created, it is essential that the marking for it is in place, before the data is read in. This is because, the marking comes in to force then.

If, for some reason, the marking of a balance account is missing. Enter the marking to the balance -column, (see Chart of accounts maintenance), and save the changes. Next, read the transactions in again, and run the reports. The report run has to include current year’s actual, at least.